September 2023

Market Update

Market Update

By Corrina Olson

Just like those of us trying to make it through record-breaking summer heat, Wall Street was suffering through the dog days of August. August is historically a tough month for the market—and this year was no different.

Market Performance

At the beginning of the month, the U.S. government’s credit rating was downgraded one notch (AAA to AA+) by Fitch Ratings. Rising debt at the federal, state, and local levels and a steady deterioration in standards of governance over the past two decades were the rationale. This downgrade, along with other factors, caused the U.S. treasury yields to move from below 4% to as high as 4.35% before ending August at 4.11%. The bond market volatility caused stocks to sell off for most of the first three weeks of the month before they staged a rebound in the final week.

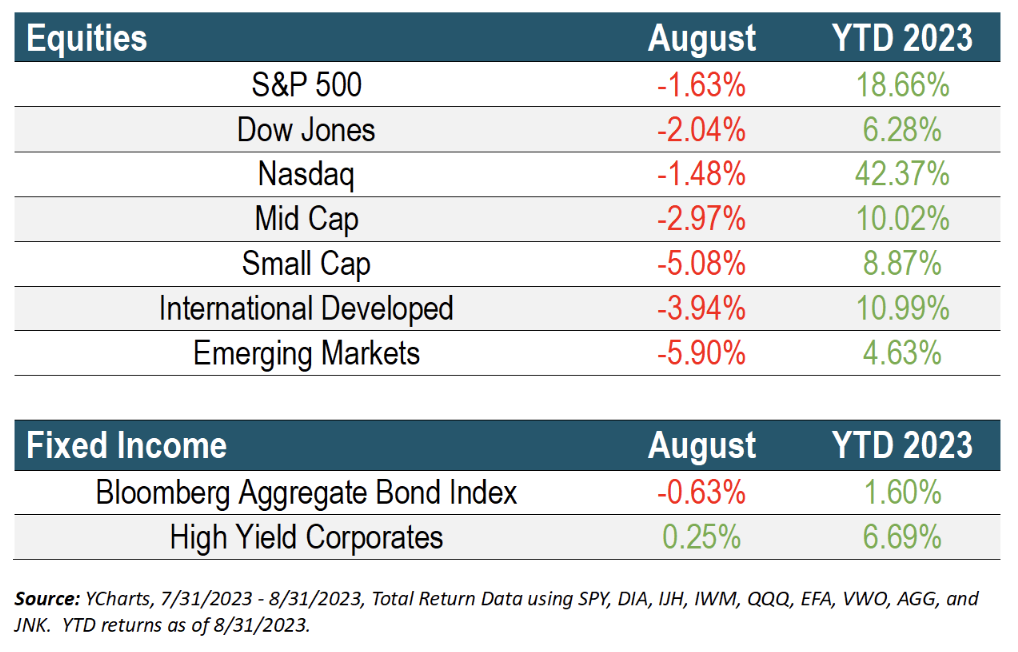

The rebound was not enough though and the month ended with U.S. equities finishing lower as the S&P 500 and Nasdaq posted their first monthly declines since February. In June, we talked about a narrow number of stocks driving returns. These stocks have been nicknamed the “Magnificent Seven.” They are responsible for over 75% of the Nasdaq gains in 2023 through July, but they saw mixed results for the month. The index declined for the month yet is still up over 42% YTD.

Economic Commentary

Attention turned to Jackson Hole towards the end of the month as the Fed met for the 46th annual Economic Symposium. In his Jackson Hole speech, Fed Chair Powell stated that while inflation has moved

down from its peak, it remains too high. July’s headline CPI was in-line with expectations at +0.2% M/M and up 3.2% Y/Y compared to 3.0% in June. Chairman Powell made it clear that the two percent inflation target will remain in place and that they will need to see below-trend growth for a sustained period to be assured that inflation is on track. They are prepared to raise rates further if needed. We have already seen 11 interest rate hikes that have pushed the Fed Funds Rate to a target range of 5.25%-5.5%, the highest level in more than 22 years. In addition, the Fed has reduced its balance sheet to its lowest level in more than two years.

The Fed reinforced that they continue to remain data dependent and one of the reports they look at is the jobs report. The most recent report offered several signs that the job market is cooling after an extremely hot run. The Labor Department reported that the economy added 187,000 nonfarm jobs in August, slightly higher than expected. The department also subtracted 110,000 jobs from the June and July tallies. The unemployment rate unexpectedly rose to 3.8%. Rising unemployment is bad news for Americans, but for the Fed it means some demand has been taken out of the economy, helping ease price pressures. And we finally saw labor participation increase to 62.8% after being stuck at 62.6% for months. This was a bright spot in the report. The rise in the participation rate indicates that the labor market is loosening as more people enter the work force, so companies won't have to scramble as much for employees, and it will put downward pressure on longer-term wage inflation. These numbers make it likely that the Fed will not raise rates at the September policy meeting. However, this doesn’t rule out another rate hike this year.

Looking Ahead

There’s still uncertainty over the extent to which the Fed’s 11 rate hikes will ultimately weigh on economic activity. We have already seen banks toughen their lending standards, Americans put themselves in more debt, and soon student loan repayments will resume. This summer, we saw a lift in consumer spending thanks to Taylor Swift, Beyoncé and ‘Barbenheimer’. But the end of those music tours in the U.S. and declining viewership for these films could lead to a “hangover effect” to consumer spending in the fourth quarter. All of this could all lead to Americans spending less and companies laying off workers if their bottom line is taking a hit.

It’s also possible the job market holds steady as recession fears continue to fade, allowing businesses to address staffing shortages. There are still many companies who say they’ve been unable to fill a vacancy due to a shortage of skilled workers. And some companies have put hiring on hold due to fears of a recession. If fears subside and with the increase in labor participation, these companies may be able to staff up.

It remains to be seen how resilient the US economy will be in the coming months. We will continue to remain nimble in the portfolios so that we can navigate this ever-changing landscape.

As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Schwab Transition

You may remember back in 2020 Charles Schwab & Co., Inc. bought TD Ameritrade. Throughout 2023, Schwab and TD Ameritrade will become one company solely under the Schwab brand. Your relationship with Copperwynd Financial will not change. Schwab automatically transferred your assets and holdings over Labor Day weekend 2023.

If you have not done so already, please establish your Schwab Alliance credentials. To set-up your Schwab Login ID and password, go to Schwab Alliance (schwaballiance.com) and select New Schwab User, then follow the prompts. You will be asked to provide your TD Ameritrade account numbers. Full account numbers are available on your monthly statements. If you need a full account number, please call the office and we can provide you with one for your account(s).

For more information about the transition, please visit https://welcome.schwab.com/. If you have any questions, please do not hesitate to contact our office at 480-348-2100.

FINANCIAL PLANNING

FRAUD ALERT

401(K) ALLOCATION

To download the September 2023 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US