October 2022

Market Update

By Jake Eggett

One of the most beautiful places that exist on this earth is Lake Powell. The desert scenery with large sandstone cliffs, endless canyons to explore, and the immense magnitude of stars you’ll see at night make it hard to beat. If you don’t yet have an appreciation or awe for Mother Earth, this place will convince you without a doubt.

Recently, I met a man who told me a story about the time he landed his small plane on Tower Butte in Lake Powell. This large sandstone butte rises 1000 ft above the lake and is roughly 500 ft long and 200 ft wide and is a common landing spot for helicopter tours.

The story unfolds by this man making a few preparatory passes to estimate his landing and then he begins to make his approach. Due to the air rising up the cliffs, he overshoots his anticipated landing spot (which is pretty small) and as his wheels land he presses hard on his brakes and skids sideways to a stop within 20 ft of the edge. This was not the soft landing that he had anticipated!

This remarkable landing made me think a lot about the Fed and the hopeful soft landing that they are trying to orchestrate. While certainly possible, the unexpectedly elevated inflation data in August cemented a larger rate hike in the recent September meeting and further reduced the odds of the economy making a soft landing. Chairman Powell’s latest comments indicated some pain will occur in the economy as the Fed continues to raise rates; whether that translates into a recession or just a slowdown in our growth remains to be seen.

Market Performance

Historically the month of the September doesn’t have a great track record and this year didn’t buck that trend. Every major asset class was down in the month of September and were highly correlated as the market made a new low for the year.

3 Major Headlines

1. Strong Dollar

It’s not often we would need to talk about currencies, but this year one of the important story lines is the strength in the U.S. Dollar. If you’ve traveled to nearly any other country in the world, you’ll notice that your dollar buys you a lot more than it used to. The dollar index is up 17.25% YTD.

Why does this matter?

It’s not so much the absolute level of the dollar but the pace of the move that matters. Major currencies generally don’t fluctuate this much in a year. When this happens, it impacts global trade. Global trade occurs in U.S. dollars, especially for the trade of essential raw materials like oil, copper, aluminum, natural gas, etc. Foreign governments pay for commodities in U.S. dollars. If their local currency falls by 20% vs the dollar, that makes raw materials 20% more expensive – regardless of any additional price appreciation. This stresses foreign budgets, causes inflation, and reduces economic growth.

As the Fed tightens by raising rates and global recession fears mount, this continues to provide strength to the U.S. dollar. The good news…a strong dollar benefits the US because imports are cheaper; therefore, lowering our inflation.

2. Inflation Remains Stubbornly High So Rate Hikes Continue

In mid-September, the August inflation report as measured by the Consumer Price Index (CPI) came in at 8.26%, which was lower than the previous month (July 8.52%) but not as big of a drop as the market was anticipating. Inflation remains stubbornly elevated, and it hasn’t been driven by just one factor. Even when you focus on Core CPI (which excludes food and energy) we saw an uptick in the latest report. These reports led the market to reprice how long and how fast the Fed will need to tighten. At the latest Fed meeting on September 20-21st, the Fed raised rates by another 75 bps and now the market seems to be pricing in a terminal rate of 4.0% - 4.5%. Keep an eye on the 2-year treasury because that is usually a pretty good indicator of where the Fed funds rate is heading, and it is sitting at 4.16% right now.

CPI is now the most important economic report each month, and the next report is due to be released on October 13th. There continues to be signs of lower inflation ahead, such as global container freight rates down 60%+ from its peak, the price of crude oil down 40% from its peak, and even used car prices down 13% over the last 9 months; however, all these items are still higher than where they were pre-pandemic.

What might keep inflation elevated?

Even though the real estate market is softening, housing prices are still significantly higher than we saw 12 months ago, and rents remain stubbornly high. Housing is the major component of CPI, representing 33% of the index. In the August report, the shelter component came in at 6.2%. CPI is notoriously slow to reflect increases in rents even though they’ve been elevated for well over a year now. Therefore, housing prices in CPI need to catch up with the real world, and this will support CPI even if “real” inflation is declining.

3. Housing Cooling

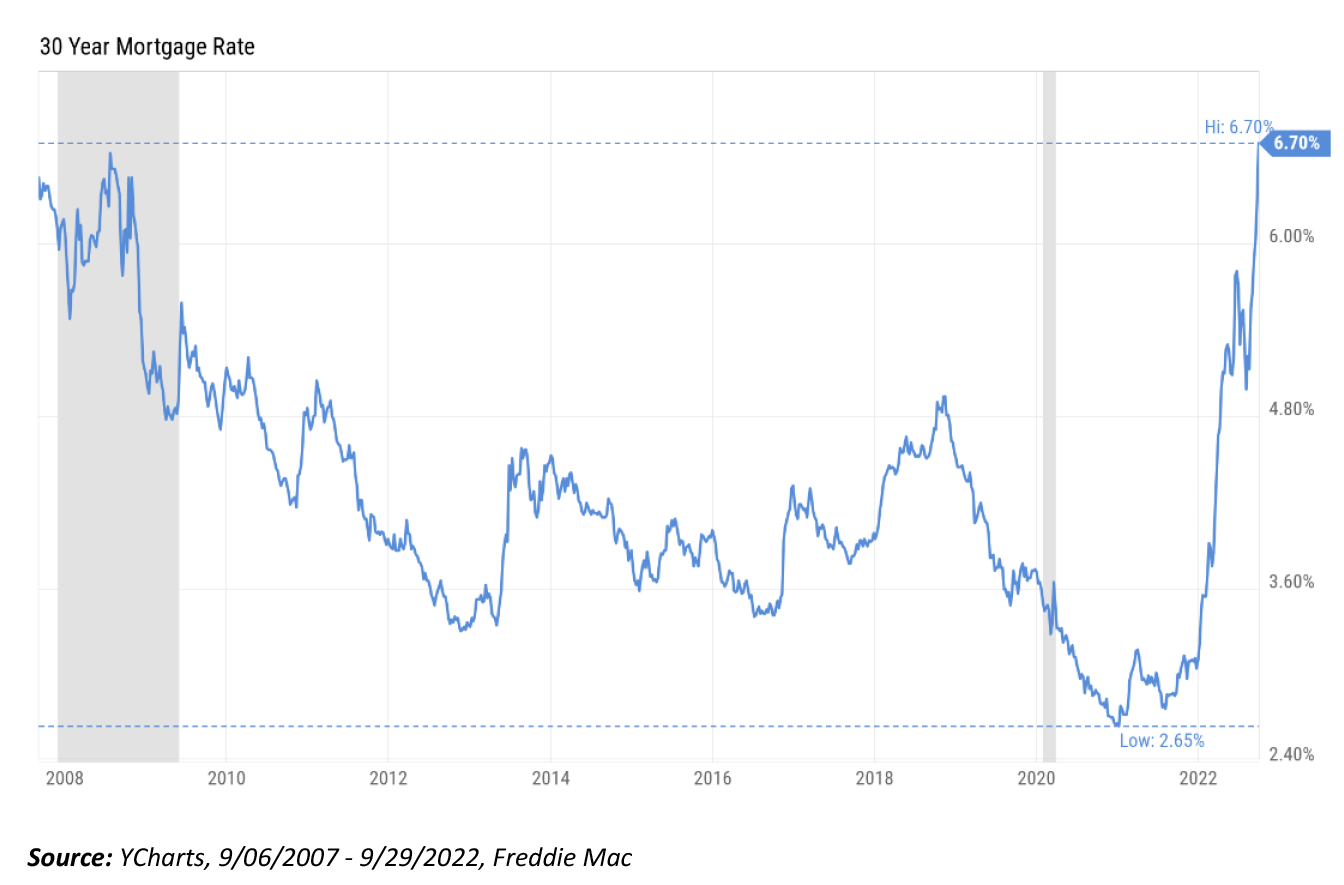

Rising interest rates continue to wreak havoc on the housing market. Again, it’s not necessarily the absolute level of interest rates rather the pace of the move that matters. The 30-year mortgage rate has more than doubled since the first of the year. Combine that with the major price appreciation of homes over the last several years and that has led to a lack of affordability for housing. The median American household would now need to spend 44.5% of their income to afford payments on a median-priced home in the US.

If Americans can’t afford housing, that will mean lower demand and lower prices. We’re just starting to see the impact of lower demand on prices. Existing home sales are at the lowest level since May of 2020 and the average sale-to-list price ratio fell to 99.2% from 100.8% a year earlier. This was the lowest level since February 2021. The chart below looks dramatic, but real estate prices have not dropped significantly yet.

Summary

Global markets are under significant stress due to rising interest rates, inflation, the war in Ukraine and weakness of most currencies relative to the dollar. As the year end approaches, we’ll need to see a drop in inflation metrics in the upcoming reports before the Fed will begin taking their foot off the gas. Over the next several weeks earnings will be in focus and if they can remain resilient that could provide some much-needed relief to the equity markets. Time will tell how soft or hard this landing will be, but currently we are still just trying to land.

At Copperwynd, we believe the equity markets are “oversold” in the short term and so a week ago we allocated some of our cash back into the equity portfolio. With that being said, the overall trend remains down and so we continue to be defensive in our positioning but want to remain nimble as the trends change. On the bond side, we are currently focused on preservation but will reposition if needed. At the end of August, we sold out of our High Yield bond positions and avoided the 4% drop that they experienced during September. You’ll see a significant amount of Treasury bills which make up most of our risk off positions. A year ago, those positions would have yielded close to 0% and now are yielding 2-3%. We think there will be some very good opportunities over the next year, and we will remain patient and disciplined so that we can take advantage as the markets recover.

Check out the Financial Planning tip for more information about our upcoming Medicare events in October.

If you have questions, please contact us.

FINANCIAL PLANNING

FRAUD ALERT

TAX PLANNING

401(K) ALLOCATION

To download the October 2022 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US