November 2023

Market Update

The October Effect

By Jake Eggett

Farewell Summer, Hello to Fall, and Ready for Winter.

Depending on where you live, your feelings about the changing seasons may vary. If you’ve endured a sweltering summer, the drop in temperature can be a welcome relief. Some of you might relish the brisk, fresh air that comes with cooler days, while others might view the approach of winter with apprehension, especially after a particularly long and harsh season last year. Regardless, October usually brings a change in leaves, cooler air, and the onset of winter preparations.

The month of October has a unique reputation in stock market history, renowned for its volatility as well as its positive turning point for markets. The “October Effect” is a perceived market anomaly that suggests there’s a higher likelihood of a decline in stock prices during October. This belief is influenced by some of the most notorious crashes occurring in October, including Black Tuesday (1929), Black Monday (1987) and the Great Financial Crisis (2008). Yet, counterintuitively, October has also marked the inception of numerous bull markets in years like 1957, 1966, 1974, 2002, and as recently as 2022.

Despite the month of October historically being a slightly positive month on average, often countering the so-called “October Effect”, this year the market was rattled by geopolitical surprises and rising rates, causing markets to decline to multi month lows. The silver lining this time of year is that the market typically enters a seasonally strong period starting in November.

The Economy and 8% Mortgages

The economy continues to be resilient, with GDP growing in the Third Quarter at 4.9%, the highest growth rate since Q4 2021. Strong consumer spending (both on services and goods), government spending and inventory growth all contributed to that number. While not expected to continue with Q4 GDP estimates expected around .9%, it shows how resilient the economy has been this year.

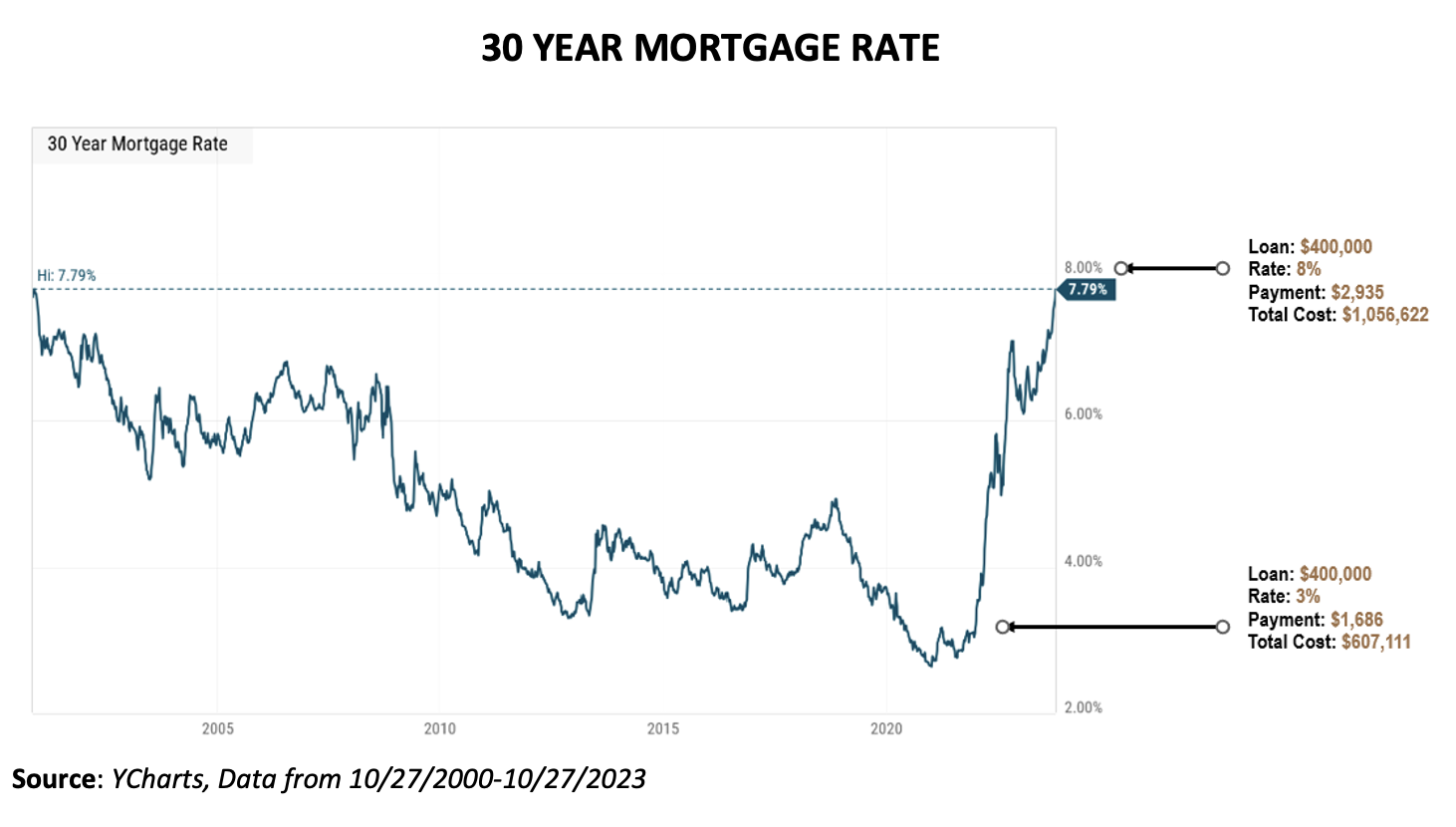

While the economy has remained sturdy, home prices have increased substantially over the last few years. And with mortgage rates at their highest levels since November 2000, the problem has compounded for new homebuyers. In fact, the U.S. housing market is now more unaffordable than it was at the peak of the last housing bubble with the median American household needing to spend over 44% of their income to afford the median priced home. In just over 2 years, the payment on a $400,000 home has increased nearly 74% or $1,250 all due to interest rates. (see below)

Why have existing home prices not fallen?

One reason is the lack of supply. Many existing homeowners with low mortgage rates are simply not selling, partly due to not wanting to give up their low rate and partly due to necessity (they can’t afford to purchase the same house they are living in at current rates and prices). While existing homeowners have been reluctant to decrease their prices, new homes are starting to see a decline in prices. Many homebuilders are building smaller, lower-priced homes in an effort to narrow the affordability gap.

Make no mistake about it, higher rates will continue to slow housing and the economy down, a basic economic principle that the Fed understands very well.

Market Performance

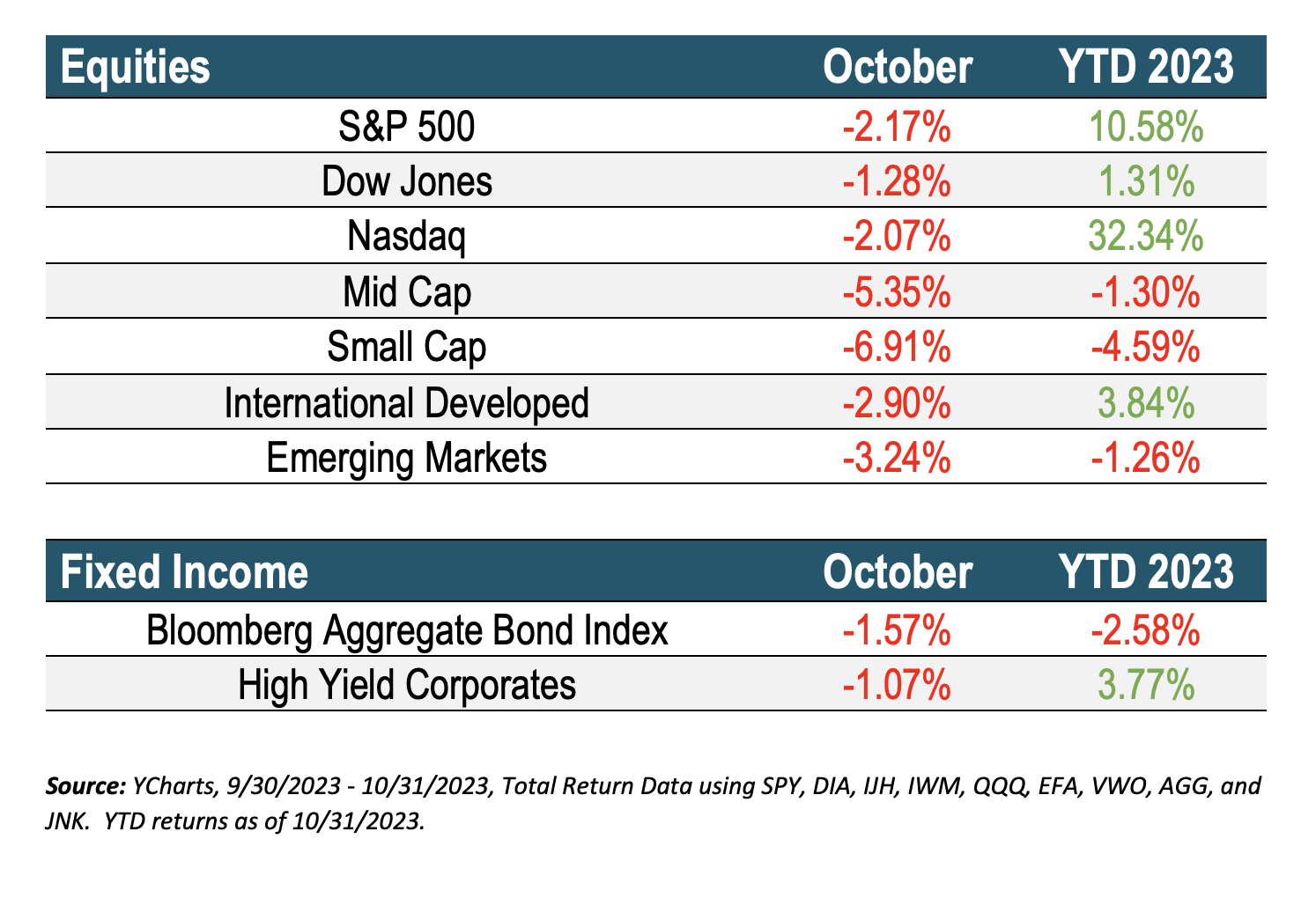

Stocks have fallen to multi-month lows not because of a deterioration in fundamentals, but instead because an overly optimistic outlook has been rattled by geopolitical surprises, rising rates and mega-cap tech earnings that have not met extremely lofty expectations (but weren’t bad in an absolute sense.) The S&P 500 is near correction territory (10% decline), while International Developed, Emerging Markets and Mid Cap have already drifted into correction mode declining between 10-14%. If you look at Small Caps, they are flirting with Bear Market (20% decline) territory, having fallen nearly 18% since their July peak.

Yields have continued to rise, with the 10-year Treasury briefly eclipsing 5.0% in October for the first time since 2007. While the recent rise in yields has centered on the longer end of the Treasury curve, it has not been contained to Treasuries alone. Higher-yielding bonds have also felt the pain as High Yield Corporates gave up some of their Year-to-Date gains.

As long as those factors (rising rates, geopolitical tensions spreading, and declining earnings growth) drive the market narrative, stocks may have a tough time rallying. With that being said, we still believe the Fed is nearing its rate hiking cycle, the Israel/Hamas conflicts appears to be localized and earnings, although not growing as fast as expected, are still holding up fairly well.

Looking Ahead

As has been the case throughout 2023, the "stock market" has been a tale of two stories. The so-called "Magnificent 7" (Meta, Apple, Amazon, Alphabet, Microsoft, Nvidia, Tesla) have broadly carried the market year-to-date. It is often cited that if you were to remove these 7 from the S&P 500, the "S&P 493" is down year-to-date, but the concentration of these seven stocks is much deeper than that. If you add up all Large, Mid, and Small Cap stocks which comprise the Russell 3000, and then remove the Magnificent 7, the remaining 2,993 stocks are down on the year. The impact of these seven companies on "market returns" cannot be overstated.

While the outperformance this year of the largest capitalization stocks has been a saving grace for the S&P 500 index, it has disproportionately influenced market returns and therefore it’s difficult to observe the fragility of the equity markets on the surface. Eventually, we will need to see wider upside participation, as P/E ratios for Mega Cap Tech companies can only extend so far and this is not the sign of a healthy market environment.

We’ll be monitoring closely if the Federal Reserve’s recent decision to keep rates steady sparks a rally or if the broad market weakness continues. Regardless, we’ll make the necessary adjustments. Given the current market trends, our models have reduced risk slightly more on the stock side, but we remain focused on U.S. Large Cap companies. As for bonds, as rates continue to increase, we have positioned a portion of the portfolio in treasuries that are yielding north of 5% and most of our bond portfolio is in floating rate bank loans. We continue to see attractive yields of 7-9% in the bond positions but we believe the key is to remain nimble. The benefit now is sitting on the sidelines finally pays you a reasonable return to wait for the trends to improve.

As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Upcoming Events:

Q4 2023 Economic and Market Update – Wednesday, November 15th at Noon MDT

Copperwynd Financial is hosting a virtual discussion for our clients to provide insight into the current economic environment and investment trends. The discussion should last 30 minutes with time remaining for additional questions and answers. To register, please CLICK HERE.

Copperwynd Financial: Commitment to Giving Back

At Copperwynd Financial, we believe in the power of community and the importance of giving back. That's why we're proud to announce that on behalf of our dedicated team and valued clients, we've made charitable contributions to a group of organizations that are making a significant impact in the lives of many.

Our contributions have supported the following causes:

St. Mary’s Food Bank: Leading the fight against hunger, St. Mary’s Food Bank provides nourishment to families and individuals in need, ensuring that no one must go to bed hungry.

Huntsman Cancer Institute: At the forefront of cancer research and patient care, the Huntsman Cancer Institute is dedicated to discovering better treatments and ultimately, cures for cancer.

Saint Jude: Saint Jude's mission is clear - to advance cures, and means of prevention, for pediatric catastrophic diseases through research and treatment, ensuring that no child is denied treatment based on race, religion, or a family's ability to pay.

Heifer International: Committed to ending hunger and poverty while caring for the Earth, Heifer International empowers families through sustainable, agricultural support, helping them build secure livelihoods that provide lasting change.

We are honored to support these organizations and their invaluable work. These contributions are just a part of our ongoing commitment to social responsibility and philanthropy.

Together, with our clients, we are making a difference.

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

FINANCIAL PLANNING

401(K) ALLOCATION

To download the November 2023 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US