May 2023

Market Update

Market Update

By Lynda Elley

Sell in May and go away? …

There are a few events in the headlines this month … the coronation of King Charles, the 23rd and final season for Blake Shelton on The Voice, the retirement of one Lynda Elley, the debt ceiling debate …

And one of these will likely result in stock market volatility that could bruise a stock portfolio. Happily, that’s not me – I will be off watching my amazing daughter graduate Summa Cum Laude from University of Arizona, so our personal investment there appears to have worked rather well! No, the headlines in the market will obviously be driven by the debt ceiling debate. The politicians are at it again and playing financial chicken with retirement security for all of us.

What is the Debt Ceiling?

For starters, what it is NOT is a government shut-down. In a shutdown, which occurs every couple of years, the government runs out of money to fund the day-to-day operations of the government. A shutdown does not impede the US Treasury Department from issuing new bonds, and this is an important point.

What it IS, is the maximum amount of money that the United States can borrow cumulatively by issuing bonds. Think of the ceiling as a type of budget that allows the US Treasury to continue to issue bonds to pay the debts and obligations of the US government for expenses that have already been approved by Congress under prior legislation. In theory, it helps to provide for fiscal responsibility as there is some check and balance to the process of running our government – no blank checks.

In reality, each party uses it as a political battering ram to further their agendas, playing for big headlines and holding the stock market hostage to the volatility that results. Make no mistake about it – a US debt default would be catastrophic, about that the press is absolutely correct. However, no one believes that the government will allow the US to default on its debt obligations, but we all believe that they will push the negotiations out to the very last minute. That delay itself could have negative consequences.

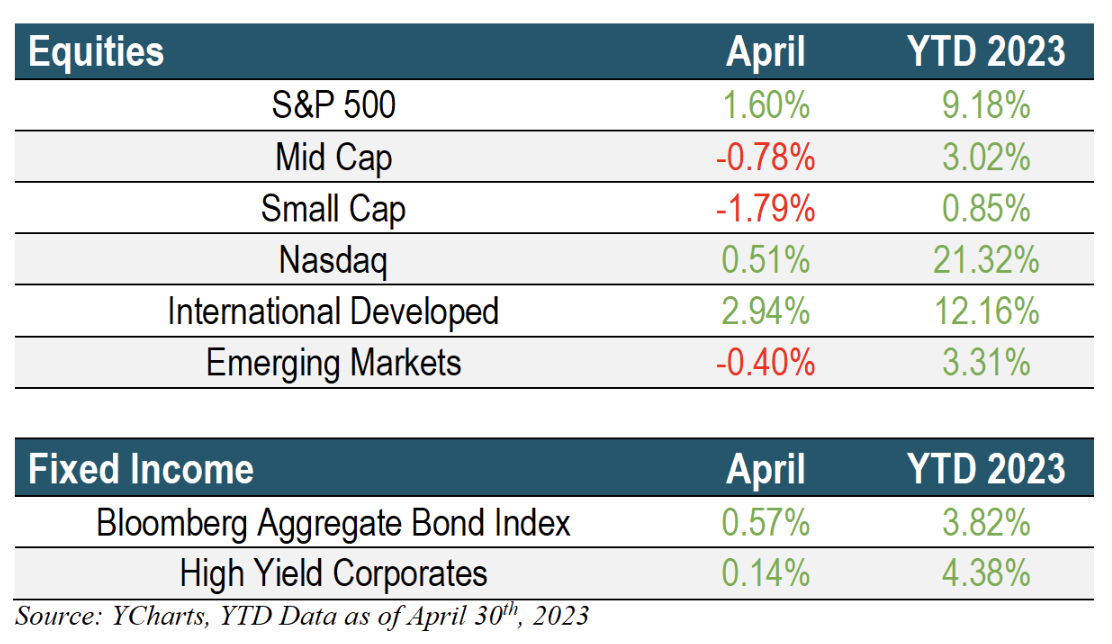

There are several parallels between this current debate and the negotiations around the debt ceiling back in 2011. Back then, as the government went into the debt ceiling discussions, all parts of the market were enjoying strong rallies, with the S&P up over 5%. As the debt ceiling conversation became acrimonious, volatility increased, and indices began to decline. Ultimately an increase was agreed upon, but not before the S&P downgraded the US debt and put us on “negative watch”. The resulting negative sentiment drove all indices into losing territory – except for commodities – and saw the S&P drop almost 20% from its peak over that summer. Markets recovered much of that territory over the final quarter of 2011 as the Federal Reserve provided stimulus that we do not think they will be able to provide this time, however.

Where there is a difference in 2023 from 2011 is where the economy sits currently. We continue to have extremely low unemployment and strong job creation in spite of the headlines we get daily on bankruptcies and layoffs! We continue to have strong consumer spending, even in the face of persistent, albeit declining, inflation. And investors have a strong belief that the Federal Reserve is at the end of their cycle of interest rate increases and the stock market reflects that positive sentiment.

So, caution going into the next 60 days is certainly warranted as the debt ceiling negotiations continue to be played out in the press, but we also see the other side of this negotiation as a potentially good entry point if you have some cash on the sidelines.

In your portfolios here we are fully invested in both stocks and bonds, with our Total Return (bond) portfolio now paying dividends higher than we have seen in almost ten years! Stocks may finish the year higher than bonds, but we still view bonds as the best risk-reward profile and with lower volatility.

As someone on the cusp of my own retirement, let me share my thoughts on the markets. I am not changing a thing. I am also crystal clear on my risk tolerance and trust the cash flow analysis that I have run, and stress tested for my family, just as we do for all of you, and we are going to be fine! And so are you.

It has been the greatest compliment to me that so many of you have chosen to share your life stories with me and place your trust in our team to help you on this journey of your own. I have been blessed, so blessed, to have had the career I have, to know that the knowledge I developed over that career was able to help make a difference in the lives of many people, and that with my transition into retirement, you are in great hands with the team here to shepherd you into your own retirement when that day comes!

I hope to see you over a cup of coffee some day soon. Now, I’m going to go make some memories.

Upcoming Events

Quarterly Town Hall

Copperwynd Financial is hosting a virtual discussion for our clients to provide insight into the current economic environment and investment trends. The discussion should last 30 minutes with time remaining for additional questions and answers.

Tuesday, May 23rd at 12PM MDT (UTAH) and 11am MST (ARIZONA)

Register in advance for this webinar by clicking here: Registration Link

After registering, you will receive a confirmation email containing information about joining the webinar.

Schwab Transition

You may remember back in 2020 Charles Schwab & Co., Inc. bought TD Ameritrade. In 2023, Schwab and TD Ameritrade will become one company solely under the Schwab brand. Your relationship with Copperwynd Financial will not change. Schwab will automatically transfer your assets and holdings over Labor Day weekend 2023.

In preparation for this change, you must have access to all your accounts online at TD Ameritrade using the portal www.advisorclient.com. Using your existing login ID and password will help ensure a smooth transition to the Schwab platform. This is the first critical step to take if you haven’t done so already.

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

If you have questions, please contact us.

FINANCIAL PLANNING

FRAUD ALERT

401(K) ALLOCATION

To download the May 2023 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US