March 2023

Market Update

In Like a Lion, Out Like a Lamb

By Jake Eggett

March can be a turbulent month for weather as the cold winter ends and the warm spring begins. The old saying, “In like a lion and out like a lamb” may apply just as much to the market as it does to weather in the month of March.

Historically the market tends to be a leading indicator of the health of the economy and as such, it begins discounting future economic weakness rather quickly and oftentimes fiercely; however, once that has happened, the market will generally move higher well in advance of the economic recovery, but usually at a much slower and calmer pace than how fast it declined. In 2022, inflation and rate increases caused the market to drop strongly and now we see the market in 2023 shifting its focus from rate hikes (although the Fed is not done) to economic growth and corporate earnings. That begs the question: will we see a recession in 2023?

This may be the most widely predicted recession in US history, so let’s evaluate why a recession may or may not occur in 2023 and the implication for the market if it does. One of the most talked about predictors for the impending recessions in the US is the inversion of the 2-year and 10-year Treasury yield curve. When the curve inverts, (meaning the 2-year Treasury rate is higher than the 10-year Treasury rate) the likelihood of a recession is high in the next 1-2 years.

In Figure 1 below, the 2-year and the 10-year interest rates are shown since 1977. In a normal environment, the 10-year is higher than the 2-year treasury rate. The reason for this: bond investors expect a higher return for loaning money out longer. Currently, that is not the case, the 10-year treasury rate is near 4%, while the 2-year treasury rate is ~4.8%. The reason this inversion is occurring is that the Fed controls the short-term rates and the market (supply & demand) controls the longer term rates. The expectation is that a recession is nearing, and investors aren’t requiring as much for longer term treasuries.

Source: YCharts, data from 01/01/1977 – 03/01/2023

In Figure 2 below, this chart shows the spread between the 10-year Treasury and the 2-year Treasury with the grey shaded areas indicating past recessions and the circles representing when the curve inverts. Interestingly, it is typically the reversal of the inversion that seems to be predictive of a recession, as opposed to the inversion itself.

It’s nearly been one year since the curve initially inverted and recently has reached the widest margin since the early 1980’s at -.89%. Persistently high inflation and expectations for further tightening by the Fed have been the main drivers of creating this inversion. So, could the predictive power of this indicator be wrong?

Some have pointed out that when you adjust the curves for future inflation expectations the yield curve is flat to even positive sloping. The strong labor demand continues to be the main counterargument for the potential for the US avoiding a recession.

Whether this time is different or not, we want to remain nimble for the possibility of a recession and further market weakness. The ability to sidestep or limit the potential drawdowns during recessionary periods can make a big difference in your long-term returns.

Source: YCharts, data from 01/01/1977 – 03/01/2023

Market Performance

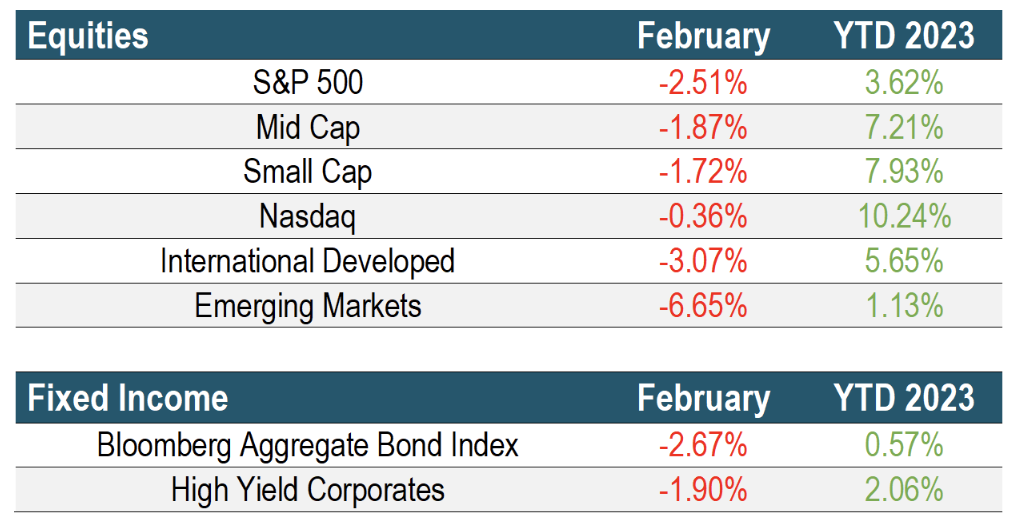

As we discussed last month, market expectations for future rate hikes have been disconnected from what the Fed has been saying and so somebody was going to be wrong. Well, February was the month that the market finally got the memo and those expectations moved closer to each other. We saw the markets give back about half of their 2023 gains in the month of February mainly due to the unraveling of the markets’ hopes of lower rates.

The US stock market was a little more resilient in February than international stocks. This was mainly due to the strengthening dollar. Will the early international outperformance continue to hold through the year? The trend of the dollar will likely be the driver of this and it’s too early to tell if this most recent uptick of the dollar is the start of a new trend or just a short-term rally. Given the hotter than expected inflation data, the market seems to be pricing in more tightening from the Fed which would have the effect of driving the dollar higher, as it did in 2022.

The 10-year treasury rate moved from 3.5% to 3.92% during February. As rates moved higher, this put pressure on bonds and the Aggregate bond index gave up most of its year-to-date gains and is now only slightly positive at .57% for 2023. The increase in yields has been a welcome sign for savers and now we have treasury rates that are above 5%. Not bad for a risk-free rate! The high-yield bond market has reversed course and it appears to be mostly due to rising rates than credit risk. (the risk of loans defaulting)

Source: YCharts, 1/31/2022-2/28/2023, Total Return Data using SPY, IJH, IWM, QQQ, EFA, VWO, AGG, and JNK. YTD returns as of 2/28/2023.

The Bottom Line

The question is why have stocks been so resilient? The answer may lie in an old market adage: “Stocks don’t discount the same information twice.” The Fed walloped the markets in 2022 with rate hike shocks, but after sustaining that beating for 12 months, the truth is that the worst may be behind stocks from a rate hike standpoint. Sure, fed funds could possibly go as high as 6%, but that’s only about 1.5% of additional tightening from here, as opposed to the 4.5% we’ve already been through. Put simply, the 2022 market was about rate hikes, and regardless of whether we get another .5% or 1.5% of tightening, the bottom line is we’re closer to an end than a beginning. Does that mean we should be extremely bullish on the market? No, it does not, and here’s why. This year is going to be all about economic growth, and if that rolls over, so will this market. Stocks may have discounted higher rates, but they have not discounted the recession that higher rates might unleash upon the economy. We remain cautious on this market and at the same time respecting its resilience.

At Copperwynd, we remain fully invested in our equity models but continue with our defensive positioning. On the bond side, with rates moving higher, we sold out of our high yield positions and moved that portion to treasuries that are yielding ~4.3%. Time will tell if this signal was a head fake but we view that as the cost of insurance in order to avoid the disaster that a year like 2022 brought on the bond market. Currently, we have 60% of our Total Return bond strategy in floating rate bank loans that are yielding between 7-8%. Even though the trend has weakened recently, those positions are very attractive from a yield and volatility standpoint so therefore we remain invested.

With all the economic uncertainty, we don’t expect volatility to go away anytime soon; however, we are hopeful that this year has more lamb-like features than the lion-like volatility that we experienced last year. As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Upcoming Events

Client Appreciation Spring Training Games

Our next game is scheduled for:

Friday, March 17th at 1:05PM – Chicago Cubs vs Los Angeles Dodgers, Sloan Fields, Mesa AZ

If you would like to join us, please email kcostlow@copperwyndfinancial.com or give us a call at the office 480-348-2100 to reserve tickets. In an effort to let as many clients attend as possible, please limit your initial request to two per family. Once you have reserved your tickets, more information will follow.

Hope to see you there!

Schwab Transition

You may remember back in 2020 Charles Schwab & Co., Inc. bought TD Ameritrade. In 2023, Schwab and TD Ameritrade will become one company solely under the Schwab brand. Your relationship with Copperwynd Financial will not change. Schwab will automatically transfer your assets and holdings over Labor Day weekend 2023.

In preparation for this change, you must have access to all your accounts online at TD Ameritrade using the portal www.advisorclient.com. Using your existing login ID and password will help ensure a smooth transition to the Schwab platform. This is the first critical step to take if you haven’t done so already.

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

If you have questions, please contact us.

FINANCIAL PLANNING

FRAUD ALERT

401(K) ALLOCATION

To download the March 2023 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US