June 2024

Market Update

June 2024

The economy and Federal Reserve policy are in focus today. Investors are analyzing every new data point to extrapolate the trend. Labor market and inflation data are considered most relevant because the Fed aims for maximum employment and stable prices. Softer labor market data and lower inflation are viewed as pulling forward rate cuts, while stronger labor market data and higher inflation delay the expected timing of rate cuts.

In early April, the Labor Department reported that the U.S. added 315,000 jobs in March, causing unemployment to fall to 3.8%. A few weeks later, data showed Core CPI, which measures inflation excluding energy and food, held steady at 3.8% year-over-year. The combination of lower unemployment and unchanged inflation signaled a strong labor market and sticky inflation, leading investors to lower interest rate cut expectations.

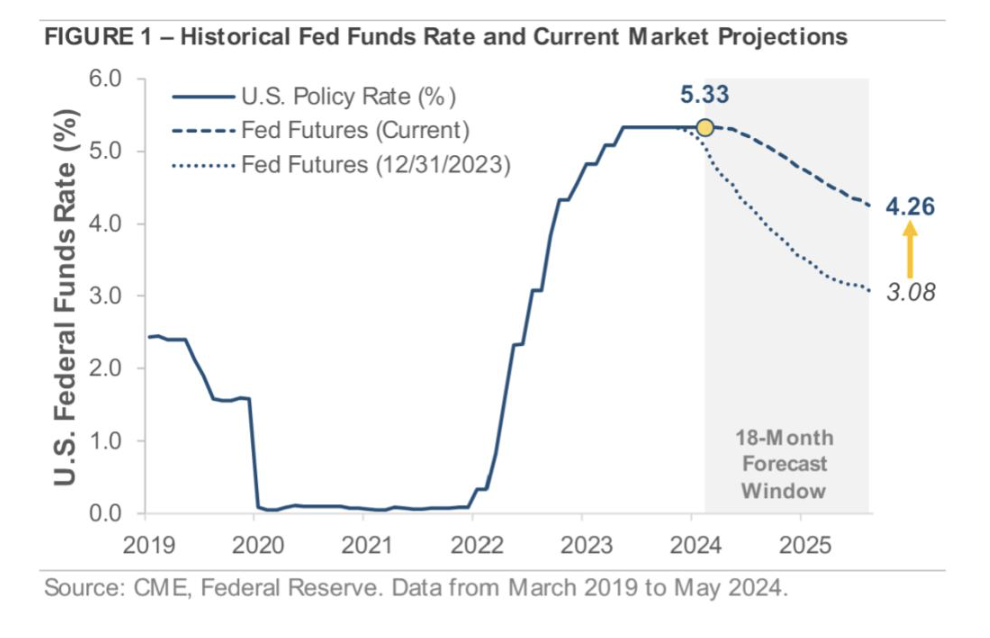

The market pushed back the expected timing of the first rate cut as inflation progress slowed. As shown in Figure 1, investors shifted to expect only one rate cut in 2024, down from six at the start of this year. Moreover, the first rate cut is not expected until Q4. If the market’s forecast is accurate and the Federal Reserve does not cut rates until December, a total of 17 months will have passed between the last rate hike and the first rate cut. How does this compare to history? Figure 2 graphs the time between the last hike and the first cut across prior tightening cycles. These ‘pause periods’ ranged from four months in 1989 to as long as 15 months in 2006 and 18 months in 1997. Compared to prior cycles, the current 10-month pause is longer than average. While the pause is longer than expected, history shows it’s not unprecedented.

In May, the latest labor market and inflation data signaled the opposite. The U.S. added 175,000 jobs, the slowest pace since October 2023, and unemployment rose to 3.9%. Inflation data revealed that Core CPI fell to 3.6% year-over-year, the lowest reading since April 2021. These data points marked a shift from the previous month, signaling a softer labor market and easing inflation. After lowering rate cut expectations in April, the market increased them in May.

As April and May showed, monthly economic data can be noisy. It can signal a strong trend one month and then the opposite trend the next month, causing investors to abruptly shift their views. This market volatility could continue over the summer until there is more certainty around Federal Reserve policy, inflation, and economic growth.

Market Performance

The S&P 500 set a new all-time high in May after trading lower in April. The technology-heavy Nasdaq 100 Index gained +6.2% and set a new all-time high, with mega-cap stocks like Nvidia, Apple, Microsoft, and Facebook-parent Meta leading the recovery. Notably, smaller companies also participated in the rally, with the Russell 2000 Index now showing positive YTD returns.

In the credit market, Treasury yields reversed a portion of their April rise. The U.S. Bond Aggregate Index, which tracks a wide range of investment grade bonds, gained +1.7% as yields fell. What caused stocks and bonds to rebound after the April sell-off? The answer: Labor market and inflation data.

Current Positioning

Our intermediate and longer-term indicators still advise staying invested in equities. However, our equity models have prompted us to make minor adjustments. While our primary focus remains on U.S. Large Cap with a growth bias, we have shifted to some mid-cap and international. We will continue to closely monitor the favorable international trends for additional opportunities.

Turning to our Total Return Bond Strategy, in April, we sold out of high-yield bonds as higher rates caused a change in trend. In early May, the trend turned around and we were able to step back into high-yield bonds. We are still focused on managing interest rate risk and are overweighted to Floating Rate Bank loans, favoring their lower interest rate sensitivity and appealing yields.

As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Client Appreciation Event – Save the date!

We plan on hosting another Client Appreciation Event at Real Salt Lake Stadium in the evening on Saturday, August 24th. For now, just save the date and expect to receive more information about tickets in the coming months!

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

FINANCIAL PLANNING

401(K) ALLOCATION

To download the June 2024 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US