June 2023

Market Update

Party Like It’s 1999

By Jake Eggett

The iconic song "Party Like It's 1999" by Prince encapsulates the celebratory mood of the late 90’s when the stock market experienced a sense of irrational exuberance, fueled by the dot-com boom. Investors were captivated by the rapidly growing technology sector and were willing to overlook traditional valuation metrics. Today, the technology sector has gathered a bit of euphoria particularly when it comes to anything related to Artificial Intelligence (A.I). Some feel that AI is perhaps the greatest investment opportunity since the internet and that it will drastically improve productivity, setting off another productivity boom like we had in the 90’s and potentially increasing annual global GDP by 7%. While that may be true, fundamentals may not matter in the short run, but they do become significant in the long run, as demonstrated during the previous technology boom. Although today’s environment differs from 1999, in the number of technology companies having actual profits, one parallel we can draw is the presence of numerous uninvited companies at this party.

The S&P 500 is made up of the 500 largest companies in the U.S. From the beginning of the year until May 31st, the S&P 500 (SPY) has returned 9.68%. However, if you look at who’s been invited to this party, the 5 largest companies have been the only ones that have shown up. The chart (Figure 1) shows that this group of 5 companies have increased over 87% while the remaining 495 companies are up less than 2%. This year’s really has been remarkably concentrated and narrow. Market breadth, which measures the participation of stocks in a particular move, is typically a reliable indicator of market strength and the presence of a broad market trend. Therefore, the current lack of breadth raises concerns.

Figure 1:

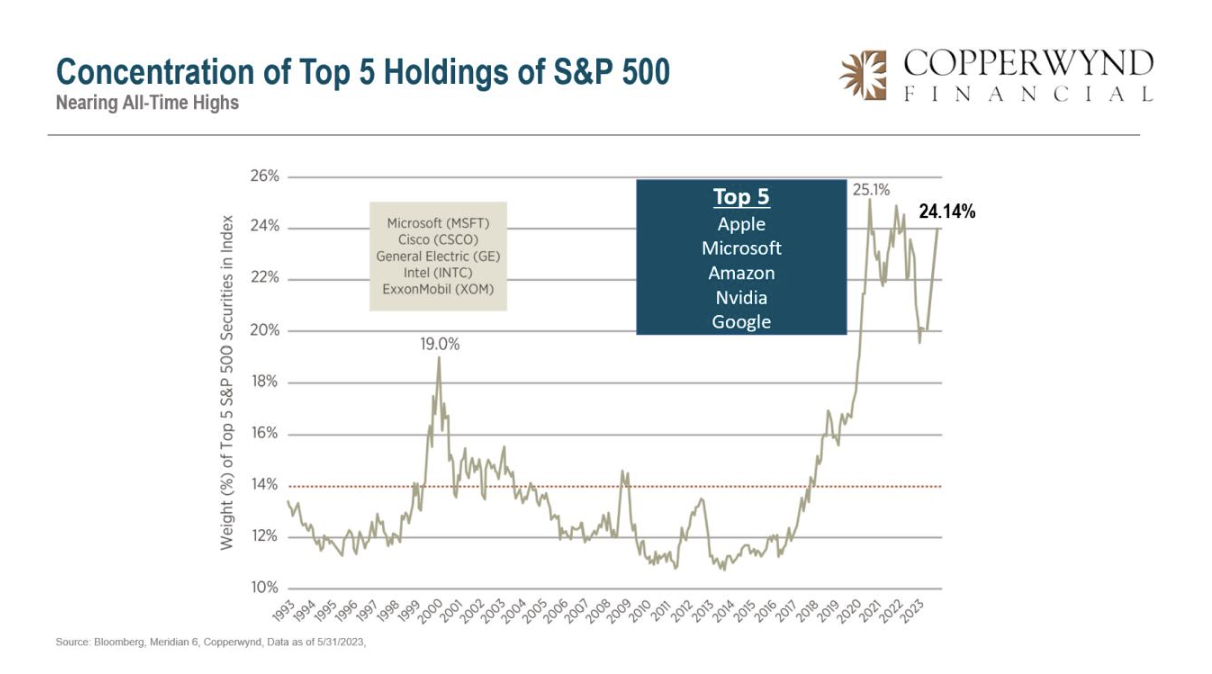

Furthermore, the S&P 500 operates as a market cap-weighted index, assigning each stock a weight based on its current share price multiplied by the number of shares outstanding. In August 2020, the top 5 companies accounted for 25% of the S&P 500 market value, meaning the other 495 companies made up the remaining 75%. The index had never been this concentrated. See Figure 2. The previous high in S&P 500 concentration took place in 1999-2000 when it reached 19%. With the recent surge in the stock prices of these companies, the concentration is back to 24%, near the all-time highs.

Figure 2:

To revert to the long-term average of 14% concentration will require significant outperformance of the other 495 stocks or underperformance from the top 5. In the last bubble, it was the underperformance of the top 5 that brought it back to the average. It would be a sign of broad market strength if the rest of the companies were invited to the party.

Market Performance

The markets were mixed in the month of May. The debt ceiling drama increased volatility throughout the month and other than the strong positive performance from the biggest companies in the US, the majority of asset classes were down for the month. The strength of the dollar contributed to International equity declines and the rise in interest rates led the bond market to give up some of the yearly gains.

As we discussed above if you take away the strong performance in technology names associated with A.I., the major assets classes have been flat this year. This year has been the exact opposite of last year. The worst performing areas of the equity market in 2022 (Nasdaq/Tech/Growth) have been the best performers so far in 2023. And the best performers of 2022 (Energy/Value) have become the worst. Small Caps and Value have underperformed this year, resuming a trend that has persisted for much of the last decade.

Source: YCharts, 4/30/2023 - 5/31/2023, Total Return Data using SPY, IJH, IWM, QQQ, EFA, VWO, AGG, and JNK. YTD returns as of 5/31/2023.

The Bottom Line

At the end of last week, the market exhibited strength driven by two factors: the resolution of the debt ceiling issue and a better-than-expected employment report on Friday. Unlike previous advances seen this year, this rally displayed strong breadth as money flowed into not only the largest companies but also small-caps and mid-caps. While it is still early to determine if this shift in the market environment will persist as a lasting change, it was a noteworthy development deserving serious attention.

The current market behavior suggests an anticipation of a Fed pause, ongoing decline in inflation, and sustained economic strength. If any of these assumptions prove to be incorrect, the market could experience another sell-off. However, if all three assumptions hold true, this could potentially market the beginning of a long-awaited bull market. As we cannot predict the future, our approach remains aligned with market dynamics, adjusting as conditions evolve.

We are fully invested in both our stock and bond portfolios, incorporating defensive measures within both sides of the portfolio. While the events of 1999 serve as a valuable lesson in the perils of unchecked enthusiasm and the importance of maintaining a balanced investment strategy. It also highlighted the importance of considering both short-term trends and long-term fundamentals. As of now, we’d like to see more companies invited to the party.

As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Upcoming Events

Schwab Transition

You may remember back in 2020 Charles Schwab & Co., Inc. bought TD Ameritrade. In 2023, Schwab and TD Ameritrade will become one company solely under the Schwab brand. Your relationship with Copperwynd Financial will not change. Schwab will automatically transfer your assets and holdings over Labor Day weekend 2023.

In preparation for this change, you must have access to all your accounts online at TD Ameritrade using the portal www.advisorclient.com. Using your existing login ID and password will help ensure a smooth transition to the Schwab platform. This is the first critical step to take if you haven’t done so already.

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

Client Appreciation Event – Save the date!

We plan on hosting another Client Appreciation Event at Real Salt Lake Stadium on Saturday, August 26th at 5:30pm (Food) and 7:30pm (Game) . For now, just save the date and expect to receive more information about tickets in the coming months.

If you have questions, please contact us.

FINANCIAL PLANNING

FRAUD ALERT

401(K) ALLOCATION

To download the June 2023 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US