July 2022

Market Update

Throughout much of the southwest this year, 4th of July fireworks displays were cancelled due to drought conditions, or shortage of either staff or the fireworks themselves! It was a bit of a muted celebration this year given all of the social challenges that continue to face our nation. Besides … the stock market has provided us with ample fireworks of its own.

The S&P 500 just realized its worst first-half performance since 1970 as initial market headwinds of high inflation and sharply rising interest rates combined with growing recession risks and extreme geopolitical uncertainty pushed stocks and bonds sharply lower through the first six months of the year.

Those declines reflect the 40-year high read for inflation at 8.6%, the Federal Reserve raising interest rates at the fastest pace in decades, coupled with China, the world’s second-largest economy effectively shut down, and the on-going Russia-Ukraine war continuing to pressure multiple commodity prices.

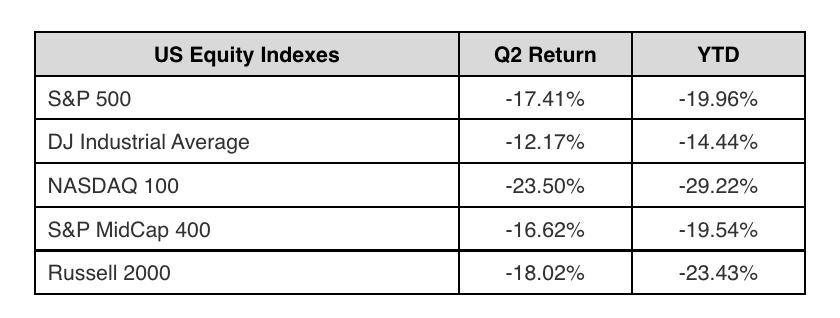

So just how ugly has it been this year?

And bonds have not fared any better. Historically, the bond market has served as a safe haven when stocks have sold off, with positive returns in the bond index (AGG) for every year the S&P has finished negative. Not so this year as we mark the end of a three-decade long bull market in bonds with the Federal Reserve raising interest rates to combat inflationary pressures. Thus far into 2022, the bond index has returned -10.35%. Short of cash, there has been no safe place to hide.

But while the volatility and market declines of the first six months of 2022 have been unsettling and painful, the S&P 500 now sits at much more historically attractive valuation levels. And at current prices, a lot of negativities have been priced into the market, opening the possibility of positive surprises as we move forward in 2022.

Regarding inflation and Fed rate hikes, markets have aggressively priced in stubbornly high inflation and numerous additional rate hikes from the Federal Reserve between now and early 2023. But if we see a definitive peak in inflationary pressures in the coming months, then it’s likely the Federal Reserve will hike rates less than currently feared, and that could be a materially positive catalyst for markets.

On economic growth, the Chinese economic shutdown has increased global recession concerns, but recently officials in Shanghai declared “victory” against the latest COVID outbreak and if Chinese economic activity can return to normal, that will be a positive development for global economic growth. Meanwhile, recession fears are rising in the U.S., but stocks are no longer richly valued, and as such, aren’t as susceptible to an economic slowdown as they were at the start of the year.

Finally, regarding geopolitics, the human tragedy in Ukraine continues with no end in sight, but the conflict has not expanded beyond Ukraine’s borders, and many analysts believe that some sort of conflict resolution can be reached in the coming months. Any sort of a truce between Russia and Ukraine will likely reduce commodity prices and global recession fears should decline as a result.

Bottom line, the markets have experienced numerous macro-and micro-economic headwinds through the first six months of the year, and they have legitimately pressured asset prices. But the sentiment is very negative at the moment, and a lot of potential “bad news” has been at least partially priced into stocks and bonds at these levels, again creating the opportunity for potential positive surprises.

To that point, the S&P 500 has declined more than 15% through the first six months of the year five previous times since 1932. And in all those instances, the S&P 500 registered a solidly positive return for the final six months of those years.

Obviously, past performance is not necessarily indicative of future results, and we will continue to be vigilant to additional risks to portfolios, but market history provides a clear example that positive surprises can and have occurred even in difficult markets such as this. Patience will be required as we work our way through this transition!

In your portfolios here, models have vacillated back and forth between risk-on (fully invested) and risk-off (to cash) several times and we currently have some cash raised by both stock and bond risk-off measures. As always, we encourage you to reach out and speak with us so we can continue to adjust your risk tolerance to meet your long-term financial plan needs.

Please join us for our next quarterly Zoominar on August 17th at noon as we discuss the outlook for the balance of 2022. An email will be sent out shortly for those of you who wish to register for the presentation and, as always, a video will be posted to our website following the event.

If you have questions, please contact us.

FINANCIAL PLANNING

TAX PLANNING

401(K) ALLOCATION

To download the July 2022 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US