February 2024

Market Update

Financial Markets

Wars everywhere, inflation, out of control deficits, constant reports of a recession around the corner, corporate earnings soft, Biden and Trump headed for a rematch, oh my. And yet, our most important barometer, the S&P 500, hit an all-time high. How can this be! As the saying goes, a bull market climbs a wall of worry, and we continue to be in a bull market until proven otherwise.

The Federal Reserve and the US government have successfully tagged teamed to pump up the market. The Fed flipped its stance and rang the “all clear” bell in the December communications by signaling rate cuts for 2024, which accelerated the financial market rally through January. The US government is doing its part by continuing large deficits, borrowing & printing a powerful infusion of incremental money into parts of the economy and GDP. Additionally, the political parties kicked the can down the road on debt/spending deals.

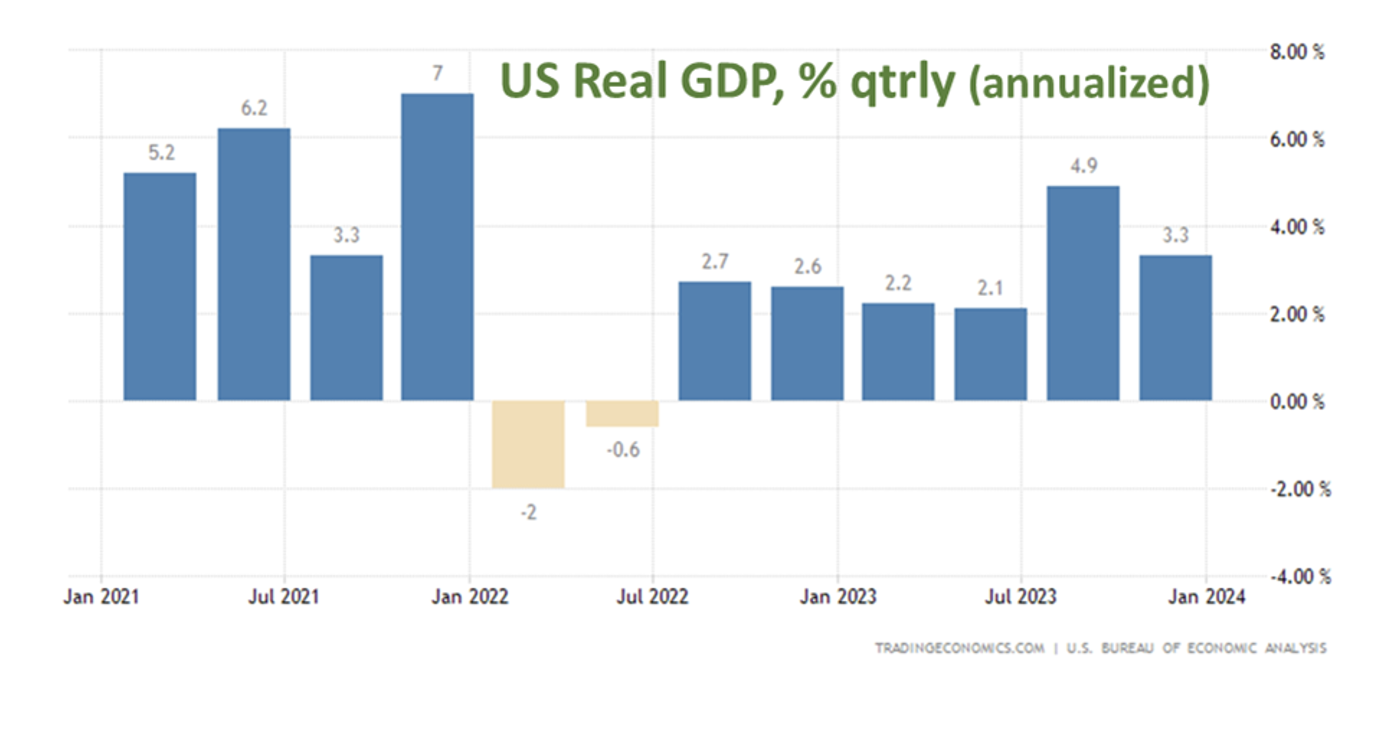

The good news continued, with the Q4 2023 real [1] GDP reported at 3.3%, blowing away the forecasted 2% (multiple revisions to follow[2]).

Full 2023 GDP growth was solid 2.5%, supported by jobs and wage growth, confounding the many experts that were confident of a recession.

Inflation continued its downward glide path to moderation at 3.9% in December, a 2.5 year low, cheering the Fed & the markets.

While still above the official 2% target, the market believes this is “close enough” for government work and will allow Fed rate cuts to follow, after a few more months on trend.

The Money supply had a huge surge in 2020 and 2021 (COVID), and now it is being somewhat reversed.

Friedman showed us that “inflation is always and everywhere a monetary phenomenon”, so we can expect inflation to continue to moderate, as the M2 changes have a lagged impact.

If things are that good in the economy, why are many feeling bad about conditions? Topline strength may be masking underlying consumer weakness:

85% of states reporting rising unemployment levels[3].

% of those with Credit Card or Auto Loan stress back to levels of 2008/09 (while Mortgage stress is OK due to rising home values).[4]

The Fed Funds Rate at 5.25/5.5% is well above the current inflation rate, so that is a drag to the economy. With the US Leading Economic Index in decline since early 2022[5], the pressure is on the Fed increases to begin cutting rates this year, striving for the elusive “soft landing”.

Financial: Official Bull Market

Good economic growth, lots of new deficit spending with reduced inflation, and anticipated rates cuts: a perfect setup for stocks and bonds. This wild party fueled the first new highs in the S&P 500 since Jan 2022. The last 12 months have seen positive returns in all major equity indexes, while International has lagged and China and Emerging Markets declining. In fixed income, the “risk on” High Yield sector has been the winner.

Earnings have not really caught up to the higher stock prices, which means P/E (price/earnings) are stretched higher. The market is forecasting strong earnings in the coming quarters (more AI please), and we will be carefully monitoring earnings results.

Just like in the economy, there have really been two different parts of the S&P 500: the Magnificent 7 and the mediocre 493 (everyone else). The Magnificent 7 are all tech leaders (often with some AI involvement): Apple, Microsoft, Alphabet (Google), Amazon, Nvidia, Meta (Facebook), Tesla. This replaced the earlier “FAANG”. These seven stocks total about $12 trillion in market cap, making up around 30% of the S&P 500 cap weight. Almost all the S&P 500 gains in the last year were from these seven stocks which gaining a whopping +77%[6]. Compare that to the equal weight S&P 500 (ETF: RSP[7],) which rose only about 7%. Price action has aligned with fourth quarter earnings trends, where Magnificent 7, in aggregate, have also significantly outperformed the balance of the S&P earnings. Leadership will rotate again, but this does illustrate the power of individual stock momentum, which we have validated and incorporated in appropriate portfolios.

The US market continues to outperform international indexes, with China and emerging markets particularly lagging. The largest cap stocks and especially the technology/Nasdaq are driving the gains, and this is where we have continued to overweight our exposure. In Fixed Income, High Yields and Bank Loan Funds are the places to be.

New highs can be scary, some ask should we be taking profits? Our models remain fully invested because our historical pattern research tells us that this bull market is not done and that it is a good time to stay invested. We do anticipate volatility and bumps along the path in the coming months, and we will quickly adjust if our models’ signals change. In the meantime, it is full steam ahead!

Upcoming Events:

Q1 2024 Economic and Market Update –

Thursday, February 15th at Noon MDT

Copperwynd Financial is hosting a virtual discussion for our clients to provide insight into the current economic environment and investment trends. The discussion should last 30 minutes with time remaining for additional questions and answers. Please register at the link provided below.

https://us02web.zoom.us/webinar/register/WN_12dwEuPeQx6S1rvbdCaMDA

Client Appreciation Spring Training Games –

Saturday, March 9th at 1:05pm – Chicago Cubs vs Colorado Rockies, Sloan Fields, Mesa AZ

Thursday, March 14th at 1:10pm – Arizona Diamondbacks vs. Kansas City Royals, Salt River Fields, Scottsdale, AZ

If you would like to join us, please email kcostlow@copperwyndfinancial.com or give us a call at the office 480-348-2100 to reserve tickets. In an effort to let as many clients attend as possible, please limit your initial request to two per family. Once you have reserved your tickets, more information will follow.

Hope to see you there!

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

[1] Real GDP is inflation adjusted.

[2] Government in coming months will likely revise this early estimate several times, and direction of revisions shows the real trend.

[3] CNBC interview 1/31/24 DoubleLine CEO Jeffrey Gundlach: Risk to economic growth could build as we move into this year - YouTube

[4] St. Louis Fed Financial Stress Index (STLFSI4) | FRED | St. Louis Fed (stlouisfed.org)

[5]United States Leading Index (tradingeconomics.com)

[6] Using a simulated equal weight portfolio of the seven, rebalanced monthly, and the RSP from dividend reinvested Norgate data/AmiBroker.

[7] In the Equal weight the magnificent 7 has just 1.4% weight.

FINANCIAL PLANNING

401(K) ALLOCATION

To download the February 2024 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US