August 2023

Market Update

Climbing the Wall of Worry

By Jake Eggertt

If you haven't experienced the heart-pounding adrenaline rush of "Free Solo," you've truly missed out on an awe-inspiring tale of Alex Honnold's death-defying ascent up El Capitan without any safety gear. The entire film grips you with nail-biting tension, your heart racing, as you hold your breath in anticipation of the perilous consequences lurking at every step. It's an astonishing feat that will leave you in both disbelief and wonder, regardless of your thoughts on the audacity of the endeavor.

Similar to Honnold's tenacious climb, the stock market frequently defies uncertainty and skepticism, ascending to new heights when least expected. There is an old saying that markets “climb a wall of worry”. Given the incredibly bizarre nature of today’s investment world, it seems the wall of worry is alive and well. Take a glance at the chart below showing the last 10 years of the S&P 500 and some of the scary headlines that we’ve gone through.

There are always issues to address when investing, but today’s environment seems much more bizarre than usual. Most leading economic indicators are pointing towards a recession, and the Fed has raised rates from 0% to 5.5% in a little over a year to combat inflation. Despite mortgage rates surging to nearly 7%, the housing market has shown resilience, likely due to the lack of supply. Don’t forget to add that in the last 6 months we had the 3 largest bank failures in history and Fitch just recently downgraded the US credit rating from AAA to AA+. Despite all these uncertainties and risks, the market has recouped a significant portion of last year’s decline and is approaching record levels.

Makes perfect sense, right?

Considering such a scary looking backdrop, one might expect that the market would be discounting prices more. Truth is there are always reasons to be fearful, just as there are always reasons to be optimistic which is why we rely on quantitative models. By removing emotions, we can focus on data-driven indicators that have historically provided an edge. Although these rules-based models aren’t flawless or predictive, they offer a disciplined approach to investment decisions. Our goal is to mitigate life-changing losses in unfavorable markets and participate in the recovery of good markets so that you can reach your financial goals. While risk can’t be eliminated entirely, these models act as invaluable guides through the market’s complexities.

Market Performance

The themes that have driven the market over the last quarter continued in the month of July. Upbeat earnings by two of the largest tech stocks and a Fed meeting that ended with no surprises, kept markets moving in the right direction. Adding to the positive tone were stronger than expected economic reports, with gross domestic product (GDP) rising to a higher-than-expected annualized rate of 2.4%, reducing the likelihood of an immediate recession. Additionally, inflation pressures eased, as the Personal Consumption Index (PCE) came in lower than anticipated. The market’s response to this positive news have been favorable, with both the overall stock market and economically sensitive bond groups showing steady, intermediate-term uptrends.

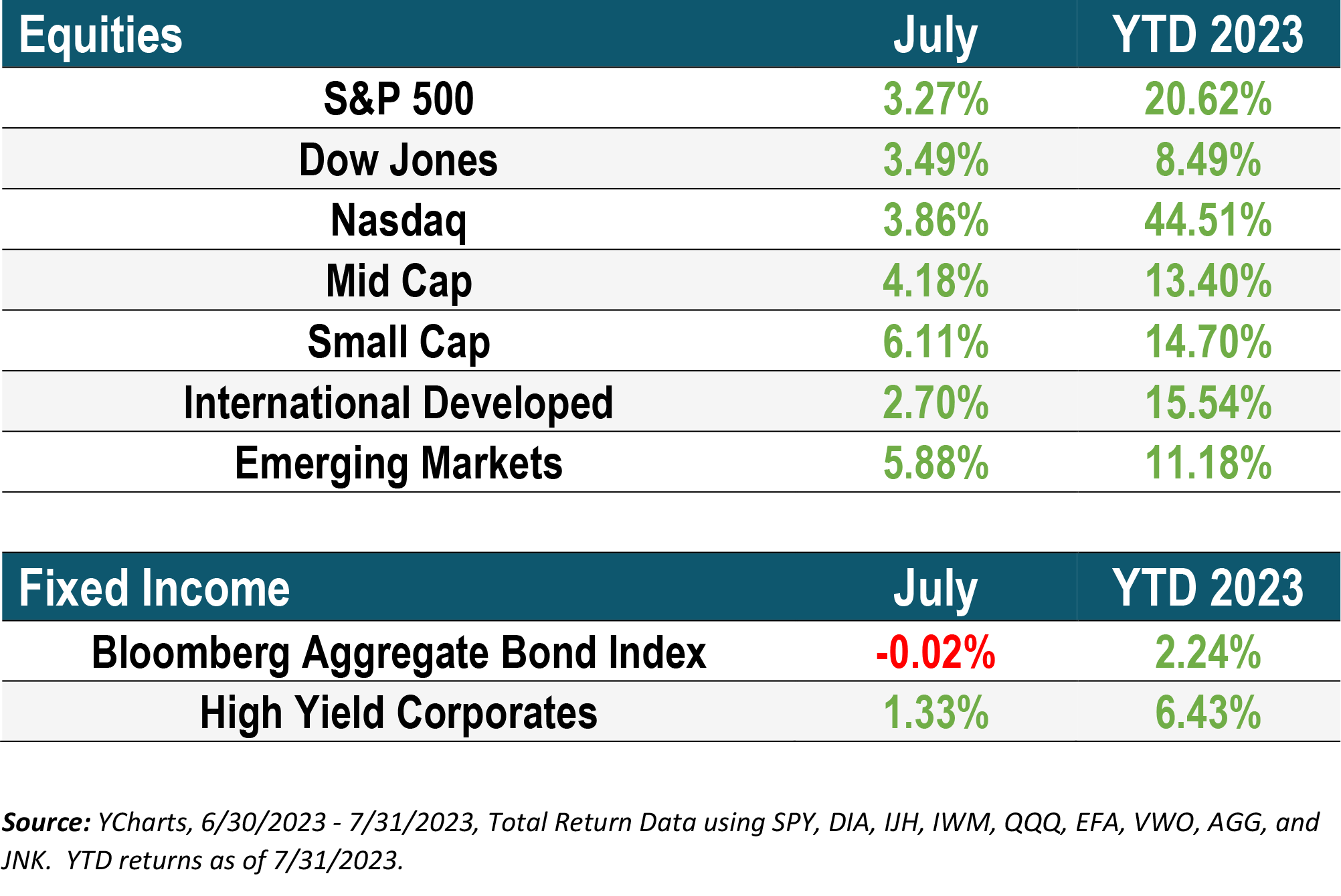

While Big Tech US Large Caps are still widely outperforming in 2023, the rally for the rest of the market has been picking up steam. We’ve seen an increase in breadth and more companies have joined the party, which adds to the strength of this trend. Nearly all the major assets classes finished July with a strong positive return, and it was encouraging to see both US Small Cap and Emerging Markets have a solid month. The lone detractor was the Aggregate Bond Index which was down slightly. The continued rise in rates was the main reason for the decline in higher quality bonds; however, junk bonds showed strength with improving economic conditions.

The Bottom Line

Looking ahead, upcoming economic reports and the remaining earnings season will play a crucial role in determining the market’s trajectory. This Friday, we anticipate the release of the July jobs report, with economists predicting an addition of 200,000 jobs for the economy. Surprisingly, fewer jobs added might be viewed positively by investors, indicating a potential decline in inflation and a market boost. Conversely, stronger job numbers could increase volatility in the opposite direction. As for earnings, approximately half of the S&P500 companies have already reported, and an impressive 81% of these companies have surpassed estimates.

The current market behavior suggests a Fed pause, ongoing decline in inflation, and sustained economic strength. However, if any of these assumptions prove to be incorrect, the market could experience another sell-off. Given the favorable market environment, our models have us fully invested in both our stock and bond portfolios; however, we acknowledge the presence of significant fundamental headwinds. We believe the key is to remain nimble so that we can navigate an ever-changing landscape in which longer-term fundamentals are in contrast with shorter-term market movements.

As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Upcoming Events

Q3 Economic & Market Update

For additional insight into our thoughts on the market and the economy, please join Copperwynd for our upcoming Q3 Economic and Market Update on Wednesday, August 16th at 7:00pm Mountain Time (6pm AZ time). Register in advance for this webinar: https://us02web.zoom.us/webinar/register/WN_og9e8fImTqaELDA8ama8jA

Client Appreciation Event – Soccer Game

Copperwynd Financial is excited to announce our Summer Client Appreciation Event in Salt Lake City, Utah! We will be hosting this event at Rio Tinto Stadium, home of Real Salt Lake Soccer team on Saturday, August 26th. Real Salt Lake is always at the top of the league and will be facing another one of the top teams in the MLS, the Houston Dynamo.

An all included Pacific Island Luau dinner will be served prior to kick off at the AFCU Pavilion at 5:30pm and game kick off starts at 7:30pm.

If you are interested in attending this event with us, please call the office or email Kim Costlow at kcostlow@copperwyndfinancial.com with the following information:

Number of tickets

Names of those attending

Reservations are on a first come basis – so register now, as these events fill quickly. We welcome you to invite friends and/or family.

PLEASE note that each household will be limited to four tickets. Requests for more will be placed on a standby list.

** There will be more information sent to attendees regarding when and where to meet and to receive your tickets. **

Schwab Transition

You may remember back in 2020 Charles Schwab & Co., Inc. bought TD Ameritrade. In 2023, Schwab and TD Ameritrade will become one company solely under the Schwab brand. Your relationship with Copperwynd Financial will not change. Schwab will automatically transfer your assets and holdings over Labor Day weekend 2023.

In preparation for this change, you must have access to all your accounts online at TD Ameritrade using the portal www.advisorclient.com. Using your existing login ID and password will help ensure a smooth transition to the Schwab platform. This is the first critical step to take if you haven’t done so already. For more information about the transition, please visit https://welcome.schwab.com/.

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

FINANCIAL PLANNING

FRAUD ALERT

401(K) ALLOCATION

To download the August 2023 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US