August 2022

Market Update

Hovering above the Salt Lake City Valley on the eastern skyline are several prominent peaks; the highest one is called Twin Peaks. Named, as you might have guessed, because there are two sister peaks next to each other. With an elevation of ~11,330 feet, the Twins rise nearly 7,000 vertical feet above the valley floor. Due to the steepness of the ascent and ruggedness of the wilderness, navigating the terrain requires some fortitude to overcome the sharp drop offs into Little and Big Cottonwood Canyons but reaching the summit will reward the hiker with incredible views of the entire Salt Lake Valley.

Having hiked this mountain many times and successfully avoiding falling to my death, I’ve learned that there is another hazard to be aware of… rattlesnakes! Although they are common in this area, for some reason I’ve come across them more on Twin Peaks than any other mountain. Once you come across a snake on the trail, you become extremely vigilant about looking for snakes. In fact, your mind starts to tell you that every stick on the trail is a snake and you become very careful of each step you take. You tend to get tunnel vision, your head stays focused on the trail, and you only focus on one thing…not stepping on a rattlesnake! Avoiding this danger and being vigilant of other hazards is extremely important when hiking, but if the risk of getting bit by a rattlesnake consumes you then you’ll miss out on all the wonder around you while you are hiking on the trail.

So, what does this all have to do with your investments and the markets? We’ve encountered an overwhelming number of hazards and risks to deal with this year and they have driven market sentiment to be extremely negative. While we can’t ignore these risks, tunnel vision and constantly dwelling on all the potential negatives will often sabotage finding the opportunities that are present and missing the many positives that surround us. Even though July presented some very negative headlines, the markets offered a little bit of sunshine in an otherwise very cloudy year.

Market Performance

The majority of asset classes rebounded strongly in the month of July to improve the YTD results, but more is needed to recoup the losses for the year.

Source: YCharts, 12/31/2021-7/31/2022, Total Return Data using SPY, IJH, IWM, EFA, VWO, AGG, and JNK

4 Major Headlines

1) Recession Risks Building

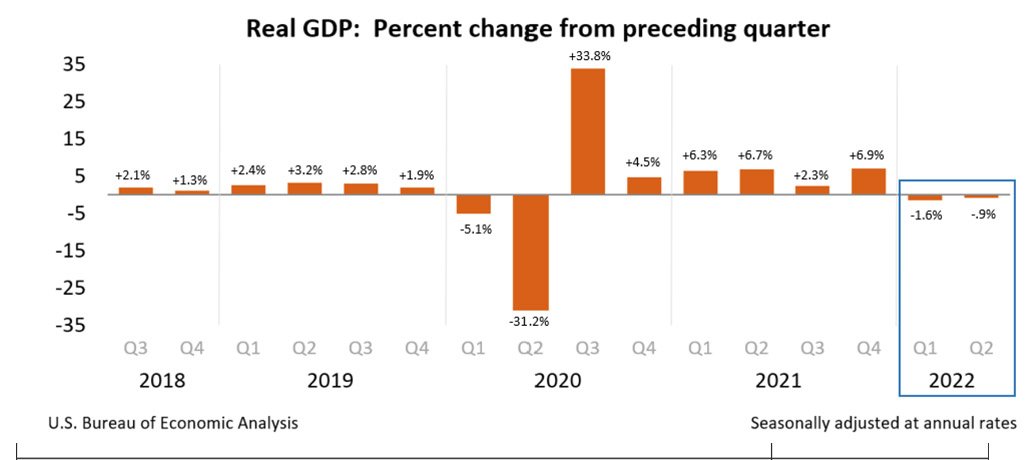

The number one risk and major question this month is whether the US is currently in a recession or will we be in one soon. The U.S. real gross domestic product (GDP) decreased at an annual rate of 0.9% in the second quarter of 2022, which is the second straight quarter of negative GDP growth (Figure 1). The National Bureau of Economic Research (NBER) is the official arbiter of recessions, and they consider a range of monthly measures of economic activity rather than just looking at 2 consecutive quarters of decline in real GDP. Regardless of whether an official announcement is made or not, we continue to see signs of slowing in the economy along with other indicators such as an inverted yield curve, which are warning signs that recession risks continue to build. On the positive side, the labor market, consumer and manufacturing activity have weakened slightly but remain strong historically

Figure 1

2) Inflation Surges to 40-year high

The US Inflation Rate, as measured by the consumer price index (CPI), has surged to 9.1% and close to 6% for the core rate that excludes food and energy (Figure 2). The latest CPI report showed inflation firm across most areas and the effects of higher prices continues to ravage not only the US but most of the world. The good news: we’ve started to see some inflationary relief in commodities such as the price of corn and wheat, both having decreased 30-40% from their May highs.

Figure 2

Also, the national price of gasoline has moved down to $4.21/gallon, a decline of $.80 from their all-time high in mid-June (See Figure 3). Time will tell if these inflationary pressures continue to subside, but for now, we’ll enjoy a little bit of relief at the pump.

Figure 3

Source: gasprices.aaa.com

3) Fed Fights Inflation

The Fed hiked interest rates another 75 basis points (0.75%) in order to get ahead of inflation and slow the economy (Figure 4). It seems to be working in the housing market as we have seen mortgage rates increase and existing home sales decrease by 21% since January. The expectations are that the Fed will continue to raise rates towards 3.5% by the end of 2022; however, the market has recently begun to anticipate lower rates in the next few years due to a potential recession and inflation declining. The risk we are monitoring closely is the Fed’s plan to reduce its balance sheet, which hasn’t materially changed up to this point. The expectation is that this will change starting in September.

Figure 4

Source: Ycharts, Copperwynd Financial

4) The Positive of Higher Rates

With the Fed raising the short-term rates to combat inflation, a positive development for savers, short-term treasury yields have moved higher! At the start of the year, the 1-year Treasury Bill was yielding .39% and has risen recently to around 3% (Figure 5). We’ve been able to take advantage of this over the past few months by shifting cash into Treasury Bills to earn some additional interest as we wait for trends to change.

Figure 5

Summary

A potential upcoming recession, inflation ravaging the purchasing power of your dollar, or the headwinds from the Fed tightening policy are hazards that have created a challenging market environment this year. We hope that you can keep your head up and enjoy your surroundings because we are constantly monitoring your investments and making the necessary adjustments to navigate the ever-changing market environment. Over the last 2 weeks, we started allocating back into the bond side of the portfolio by adding High Yield and Bank Loans and if the trends continue to persist, we hope to get back to being fully allocated. The equity side of the portfolio remains defensive but as the short-term trends have improved, this has led to incremental exposure being added to stocks. As always, we encourage you to reach out if the market is keeping you up at night.

Please save the date for our quarterly Zoominar, which will be held on Wednesday, August 17th at 1pm UT (12pm AZ). We plan to share additional commentary on the economy, markets and investment trends. Register in advance with this link:

https://us02web.zoom.us/webinar/register/WN_x58oTPZfRvysIm6gIyU3-w

If you have questions, please contact us.

FINANCIAL PLANNING

TAX PLANNING

401(K) ALLOCATION

To download the August 2022 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US