March 2024

Market Update

Financial Markets

Recession Called Off

We start with some great news! The Conference Board, the creator of the “Leading Economic Index”, officially canceled their recession call. They had previously been predicting recession for every quarter of last year and for the 1st half of ’24. They have finally thrown in the towel, as their index is showing improvements, led by the surging stock market. A bull market just makes everything better.

To be fair, most economists had been predicting a recession since 2022, and one thing we do know – when almost all forecasters (or the market) all agree on something, you can count on that forcing a different outcome.

Currently, we expect a mixed and somewhat slowing growth rate in the US this year, with Q1 ’24 in the low 2% range, driven by a more accommodative Fed but lacking any new surges of big stimulus spending from DC. However, DC recently avoided a partial shutdown by extending funding deadlines later into March.

One area particularly struggling is commercial real estate. The painful adjustment from not as many workers clocking into traditional offices creates buildings that have big vacancy rates (see chart). These owners then struggle with paying the debt on the buildings.

Globally, recession is still playing out. Both Japan and the UK revealed in late February that they had retreated into “technical recessions” (two consecutive quarters of year-over-year GDP contraction). Key Asian countries like China are doing strong interventions to try to avoid recessions. US growth outperformance is helped by lower energy prices increases compared to Europe and elsewhere (Ukraine/Russia sanctions).

Inflation Slowing with Bumps

Real life data does not follow a plan and is messy; January’s CPI at 3.1% and the Core CPI at 3.9% (excluding food & energy) came in hotter than expected, causing momentary market unease, and impacting Fed rate cut predictions. Although inflation has remained stickier than hoped for, when we take a step back and look at the graph, we believe the overall inflation trajectory remains favorable.

Fed Rates

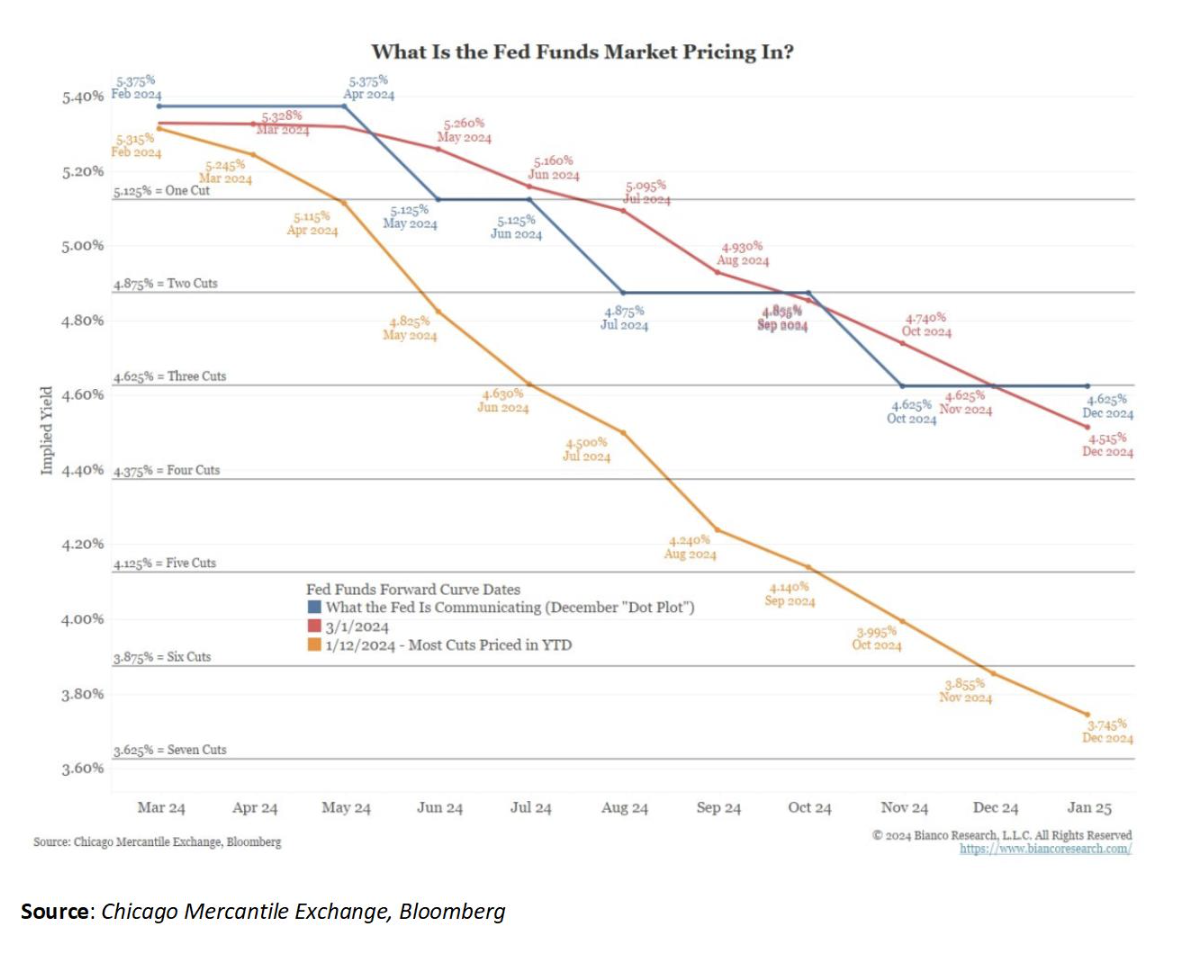

While the Federal Reserve is perceived to have concluded its rate-hiking strategy, the market expectations for rate cuts have been delayed. Initially, the market anticipated the first rate cut in March, with a forecast of 7 cuts by year-end. However, due to persistent inflation, the market has pushed back the expectation for the initial rate cut to June. The current market outlook, as depicted in the chart, predicts year-end rates around 4.5%, indicating a reduced expectation of 4 rate cuts for the year. This adjustment has likely been influenced by recent economic data and a strong stock market, but the good news is that is now more aligned with what the Fed has been communicating.

Market Performance

Is there a market, or is there just Nvidia overshadowing everyone else? Following another outstanding quarter, Nvidia achieved the largest single-day market cap gain ever, soaring by +$277 billion, pushing its total market value to approximately $2 trillion. This places it among the top 10 annual country GDPs, rivaling Canada. Nvidia’s rise is much more grounded in remarkable sales and profit growth, setting it apart from historical comparisons such as the dot-come bubble.

Is it overpriced? It depends on future innovation and competitive breakthroughs, but it is priced at 32 times sales, so diversification continues to be a prudent approach.

Throughout February, the broad indices displayed resilience, and recent weeks have revealed indications of expanding strength beyond the dominant few, extending into mid/small caps and international sectors, which is an encouraging development. Despite a slight upward movement in rates during February, leading to a decline in the Aggregate Bond Index for the month, the positive interplay of higher yields and narrower credit spreads allowed junk bonds to attain a modestly positive performance.

Looking Ahead in 2024

After such a historic run, naturally, the narrative has quickly shifted to wondering if NVDA (and tech stocks in general) are overvalued. The ongoing debate on a potential bubble hinge on these companies’ ability to continuously meet the soaring earnings expectations. It’s clear that relying on a handful of companies for market results increases the likelihood of significant market swings, both upward and downward, translating into heightened volatility. In navigating the coming months, maintaining diversification, and adopting a strategic approach may prove advantageous.

Currently, our Total Return Bond Strategy remains in a “Risk-On” position, still fully allocated. While US High Yield has entered a somewhat rangebound state in recent weeks, we continue to favor senior loan/floating rate positions, which are less interest rate sensitive and have more attractive yields. Managing interest rate risk remains crucial in our view. Despite the prevailing sentiment suggesting potential rate cuts in 2024, the Federal Reserve remains data dependent. Any unexpected data, especially related to employment and inflation, could trigger sudden shifts in interest-rate-sensitive bonds.

As always, if you are concerned about your risk level, please reach out to us, and schedule a time to review your allocation and financial plan.

Upcoming Events:

Client Appreciation Spring Training Games –

We have fully booked out our upcoming client appreciation events. As a reminder for those who signed up, you’ll be getting an email with all the details soon.

Saturday, March 9th at 1:05pm – Chicago Cubs vs Colorado Rockies, Sloan Fields, Mesa AZ –

Thursday, March 14th at 1:10pm – Arizona Diamondbacks vs. Kansas City Royals, Salt River Fields, Scottsdale, AZ

Look forward to seeing you there!

If you have any questions, please do not hesitate to contact our office at 480-348-2100.

FINANCIAL PLANNING

401(K) ALLOCATION

To download the March 2024 Newsletter: CLICK HERE

Ready to map your financial path? CONTACT US